It is that time of the year again! As we swing into Q4, and whilst it is easy to get focussed on the sharp movements in some freight markets in recent days, thoughts may begin to turn towards what the new year may bring. One of those key areas of interest for the tanker market, is the inevitable flat rate changes.

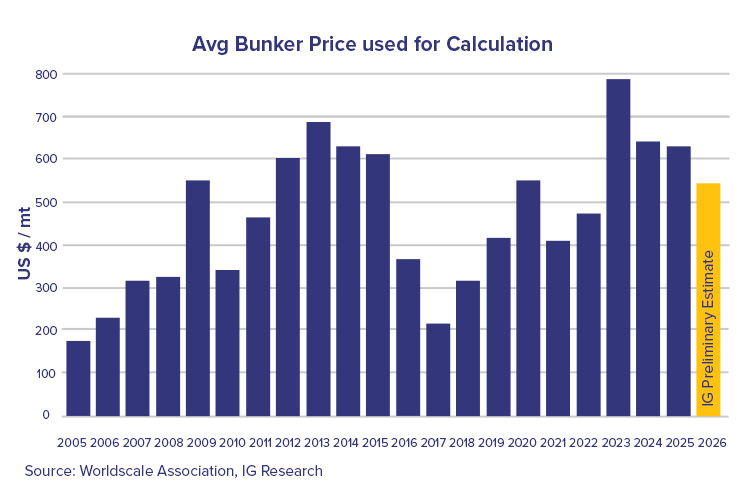

Traditionally the flat rates have always been most sensitive to the changes in the bunker prices. This obviously depends on the length of the voyages for which the rates were produced as well as the type of fuel burned, but in general, historical bunker prices have always been a good indicator of the flat rates movements and are used as a major component to try to assess potential changes for next year.

The window for 2026 flat rate calculations covers the period October 2024 to September 2025. Despite some notable peaks, especially in the face of geopolitical uncertainty, crude oil pricing and therefore bunker prices have trended downwards across that same period. Whilst we await the final September bunker data published directly from Worldscale, we estimate that LSFO bunker prices will have declines by approximately 13% relative to the same bunkers used during 2025 flat rate calculations. MGO pricing, of particular note to those flat rates that pass through or trade in ECA zones have moved similarly, with an estimated 15% decline in pricing relative to the same periods.

These bunker price declines will be reflected in an estimated 7% decline in flat rates calculated predominantly with LSFO bunkers, and an approximately 8.6% decline for those ECA based voyages. These figures are based on the average estimated changes across the full basket of tankers routes assessed by IG and the specific route by route changes will clearly deviate from these values. It is important to note that fluctuations in port costs and exchange rates, which have the potential to significantly impact flat rates, especially on shorter-haul voyages, have not been incorporated into these estimates.

The one point of additional interest for 2026 flat rates will be in the inclusion of the Med ECA zone directly into the flat rates. The Med ECA came into force on the 1st May 2025, and mandates the burning of fuel with maximum sulphur content of 0.1%, as per other global ECA zones. These higher grade bunkers are priced at a premium to the current base LSFO bunkers. This obviously means that for those flat rates run exclusively, or predominantly within the Med ECA, there will be a significant jump in bunker costs, estimated to be around 9%. For a voyage entirely within the new Med ECA, this translates to an increase in flat rates of approximately 5%. Clearly this will vary significantly depending on the overall proportion of a voyage within the new Med ECA.