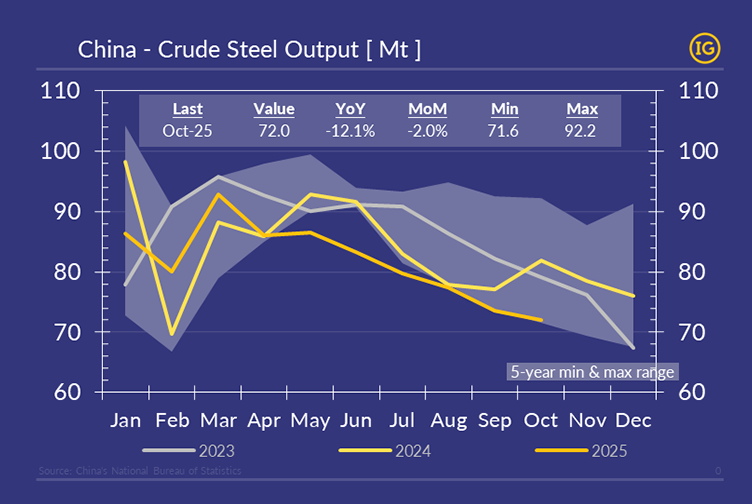

… down -12% YoY, reflecting soft domestic demand and reinforced 2H’25 supply discipline from NDRC & CISA.

Cuts were uneven: Blast Furnace iron output fell -6.7% YoY, while Electric-Arc Furnace plunged -38% YoY, according to our estimates.

Firm iron ore prices above 100 $/t and deteriorating margins — with our Rebar spot margin proxy turning negative in Oct’25, the lowest since the 2015 crisis and pre-BRI — forced mills to scale back further, reinforced by northern pollution controls.

The challenge ahead is threefold: restoring margins, meeting environmental constraints, and reigniting demand.

For further insights, contact research@IfchorGalbraiths.com.