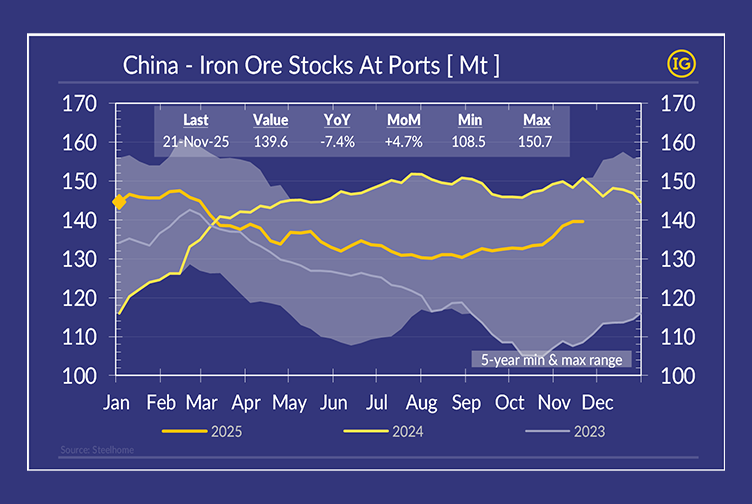

The build reflects sustained >100Mt/month arrivals in Jun–Oct, as Australian and Brazilian suppliers continue catching up on annual volumes after early-year weather delays.

Steel fundamentals remain soft with crude steel output down -4.1% for Jan–Oct, including EAF down -20% YoY, while Blast Furnace eased just -0.8% YoY. Despite prices holding above 100 $/t, domestic mining fell -2.6% in Jan–Oct, tightening local supply and directing more material through the seaborne-to-port chain.

For further insights, contact research@IfchorGalbraiths.com.