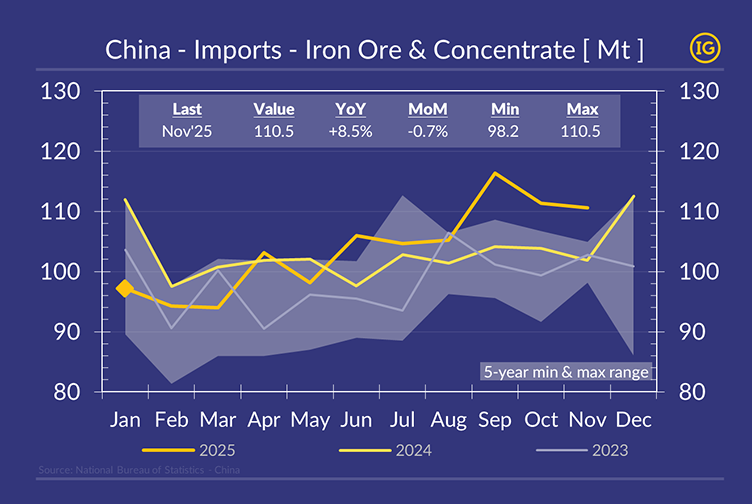

…taking Jan–Nov arrivals to an all-time high of 1.14Bt (+1.3% YTD) despite iron ore consumption falling -0.8% and crude steel output declining -3.1% over the same period. Recent loading activity points to another YoY increase in Dec’25.

The supply-led nature of the surge is underscored by iron ore inventories at Chinese ports rising +6Mt through Nov’25, consistent with miners catching up in the second half of 2025 on cargoes delayed by adverse weather in the first half.

For further insights, contact research@IfchorGalbraiths.com.